Scammed: Your Money is Not What You Think It is

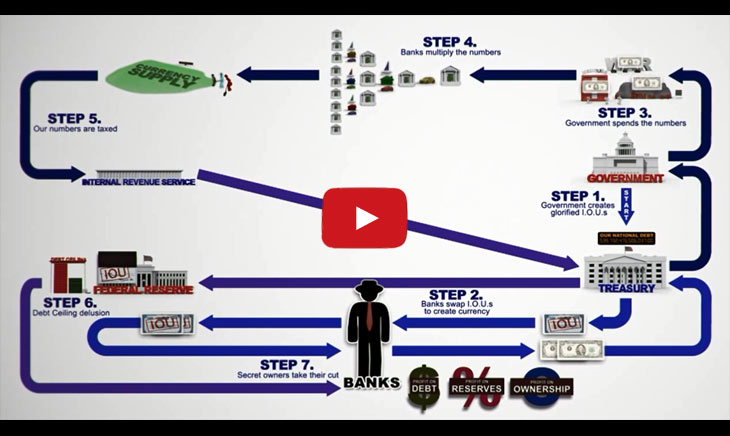

I’ve watched this extraordinary video and it confirms the doubts I have during my wealth building journey. The video does a great job of explaining the current monetary system and how it translates into nothing more than the biggest scam in the history of mankind.

What? Why? How? Let me explain…

When money first came into circulation, it had a specific value attached to it. Meaning that whether it was a coin made of wood, rock, silver or gold, or some other physical item, it represented something of value. In fact, anything that has an agreed upon value can be used as currency. The real reason money was used in the first place was as a substitute for trade items, such as grain, livestock, transportation items, implements/tools and building materials.

As you’ll soon learn, things have changed right under our noses. Money is now more representative of debt than it is anything of value. Let’s take a brief history lesson about currency before examining what it is in fact currently.

Barter System Money

The first form of currency was the barter system. Starting back to the origins of man; even before he could perhaps speak. You traded items you had for those that you needed – with people who had what you needed and wanted what you had.

Make sense?

Say you need a horse, and you have many barrels of corn to trade with. In the barter system, you’d have to find someone who’s willing to trade you a horse for a set amount of corn. Obviously, unless there’s a shortage of food, a horse is likely worth more than a barrel of corn.

So, what if that horse is only worth a barrel and a half of corn? You have to separate a barrel in half. Not to mention lugging it around, and the person with the horse having to come pick up their trade item and lug it away – all before automobiles existed!

No easy task…

Substitute Money

Enter substitute money. Coins, notes, etc. that represent a placeholder for trade items. Civilizations adopted the process, whereby a coin or other item was assigned a set value (the Chinese used knives with holes in the top that could be strung on to a string – a “Wei Dynasty wallet”, if you will.) You could receive the currency from selling a valued item, then use that currency to purchase something you needed, without lugging heavy items around with you.

Commodity Money

Then came commodity money, which was in existence til 1971-73 after the “Nixon Shock” permanently floored the effective conversion of gold bullion into paper dollars.

Commodity money placed a specific value on the currency item itself. While that currency could still be a simple coin, piece of paper, or even livestock – the said currency was no longer a placeholder for another item, it actually had a value of its own.

Confusing indeed, but that’s how it was…

Some cultures used copper, gold, silver, and other precious metals for coins. Still others, like the Aztec culture (who used cacao beans as currency) used natural items that had an actual monetary value.

By the 20th Century, we were all using paper and coin currency which was based off silver and gold. Rather than being a mere place-holder like the substitute money used in the barter system, or an item with monetary value, modern paper and coin commodity money represented a set weight of gold or silver.

Jack Weatherford an anthropologist and author of the book The History of Money tells us:

“Unlike paper money and cheap coins that can easily lose their face value, commodity money has a value in and of itself and thus can always be consumed no matter what the status of the market.”

Paper Bond Money

After the early 70’s money has become nothing more than a promissory bond, based on money that doesn’t even exist yet! Countries are so far in debt, they don’t have any physical assets to back the currency up with.

Bet most of you though that gold and silver still had some sort of bearing on the value of a dollar, didn’t you?

photo credit: Unhindered by Talent

Modern money is supposed to be representative of a country’s assets, minus their debt load. That makes sense right? Unfortunately, collusion and greed have entered the process. Governments sell their debt, while other governments use bonds to buy that debt and make money off the interest. It’s quite hard to explain it all in a way that can be understood.

Basically, if you think that you’re debt free, just look in your pocket or at your bank balance – as an American citizen you’re in debt! That paper is an “I Owe You” to be paid back in the future to some other foreign land. But don’t worry, that same country likely owes us money too – and with interest!

With many countries being millions and trillions in debt, chances are good that your children, grand children, etc. will be paying back these “promissory notes” for the rest of us.

The same is true for other currencies too. Unless, your country’s central bank isn’t carrying any debt load.

Takeaway

As controversial as it may sound, the facts are there. Now, it’s all up to you: What are you going to do about it? Are you going to rely on your I.O.U. a.k.a. currency to build your wealth, or are you going to take action and secure your hard-earned currency into a more viable investments, such as gold and silver?

Before you go, this poster is pretty much the recap of what you’ve watched. View it, print it, share it – your choice. You can download it by clicking on the image below.

Remember, wealth building is all about decision. What you decide today may affect your children and grandchildren’s future. So, consider your options well and get proper financial education – the resources are out there, many are available for free.

Take action, today.