You’ll recognize most of them. Some of the others mentioned here will surprise you, until you learn more about them, read their blogs, follow their “Tweets”, and watch your portfolio grow larger by the day because of their advice. 1. Warren Buffett There are tons of copycat Twitter accounts for this man. The world’s 4th richest person (source) has willed his wealth to charity when he dies. His blog is updated VERY frequently, though it wouldn’t be much of a stretch to assume he’s probably too busy to bother himself with even half the material that gets posted. Still, the

Continue reading…

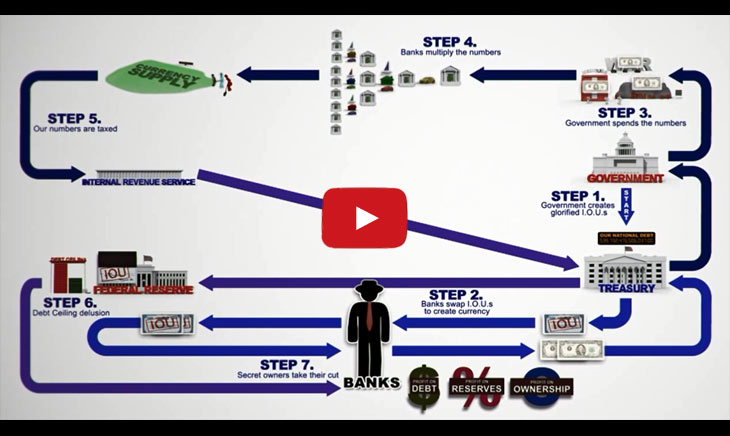

Must Watch: The Biggest Scam in the History of Mankind

The short, yet still wholly undetermined answer to the title question is: No. Bitcoin is still a very young currency – there are bound to be a few bumps along the way. How many countless dollars have been stolen from banks over the years? How many dollars, Yen, Pounds, etc., have been counterfeited? We (humans) find value in some of the strangest things. And where there’s value, there’s speculation related to supply, demand, security, world events, etc., that will cause that value to go way up – then sink way back down – only to shoot for the skies again.

Continue reading…

Ah, to own that crown prince of a property in the wealthiest part of town. That is the American dream isn’t it? Put up that massive chunk of cash you’ve been saving for the last ten years as a down payment, so you get the best mortgage rates, and dive right in right? That’s not why you’re here though. You want to achieve another part of the American dream. One where you’re financially secure, maybe with a Porsche or Lamborghini parked in the drive, and an Island in the South Pacific that you own outright. You’re an investor looking to

Continue reading…

There’s a lot of issues to consider when attempting to determine the current state of the USD, and the entire fiat system that backs it and other currencies. Six years after the collapse of the US banking industry, we’re still printing money like it has no consequence, raising inflation levels into frightening territory just like it was before the last collapse. There are few outcomes that can result from vigorously printing money in order to feed a teetering economy; none of them are good. Is the USD still the dollar of choice? Yes. Can we just keep printing empty money,

Continue reading…

If you’re in the market for a hot investment, and have some disposable income that you don’t need to have immediate access to right now, then you’re about to get in on a super-huge, massive tip that’ll have stupendously-positive repercussions in the coming years for your financial portfolio! So what’s the deal with silver you’re saying? The silver standard ended in the latter half of the last century. Where’s the demand? Jewelry? There is a demand, just not for the things you’d normally associate silver with… There’s a lot of really good data that makes this commodity more than just

Continue reading…

What makes a currency strong isn’t necessarily what makes it popular or valuable, as you’re about to read. In fact, the most popular form of currency, the USD is steeped in debt with nearly 17.5 billion owed by the nation’s government (source). Furthermore, the current capital to assets ratio (Capital Ratio) of the US Federal Reserve is a slowly improving 11.3%. Not the best numbers, but far from the worst either. So mull those numbers over while you read the rest of this. Do you think the USD is still on top? A fiat currency (what is it, anyway?) a.k.a.

Continue reading…