Unstable Bitcoin Values Leaving You Hot Under the Collar? Will Bitcoin be Replaced by a New Cryptocurrency Soon?

The short, yet still wholly undetermined answer to the title question is: No. Bitcoin is still a very young currency – there are bound to be a few bumps along the way.

How many countless dollars have been stolen from banks over the years?

How many dollars, Yen, Pounds, etc., have been counterfeited?

We (humans) find value in some of the strangest things. And where there’s value, there’s speculation related to supply, demand, security, world events, etc., that will cause that value to go way up – then sink way back down – only to shoot for the skies again.

The interesting thing about the Bitcoin values is there really hasn’t been more than a slight stutter regarding investor’s value perception of the coins. The chart on this page shows an ever-so-slight dip since the harried situation with BTC China at the end of 2013, and even the MTGOX scandal hasn’t killed the value.

You might be thinking to yourself: “Ha! An ever-so-slight dip? You’re crazy man! A couple short months ago, Bitcoins were worth nearly $1,200 a piece.”

And now the current value is around $675 per. It’s been as high as $700 since March 2014 began, and as low down as $400 on February 25 of this year (source). Of course investors will get scared now and again, especially when the world’s biggest cryptocurrency exchange just fell flat on its face.

MTGOX gone…

As many of you may be aware, MTGOX filed for bankruptcy on Feb 28 (see more). With his head bowed down in a surrendering gesture, Mark Karpeles told the world that a security breach (which wasn’t discovered until much too late) had caused the theft of approximately 850,000 Bitcoins!

Is anyone feeling just a bit angry about this whole situation?

Not only have the selfish hackers who stole the coins put the entire value of the currency in jeopardy; what bloody “digital hole” have the folks at MTGOX been living in?

How can any company who handles currency in this day and age have security issues that allow someone to pilfer a half-billion dollars at the time ($300,000,000 if you count the current value and not the value preceding the attack) in Bitcoins without someone catching it?

So many questions…

Worse, MTGOX tried to blame the Bitcoin system for the problem; though expert sources have confirmed that it was a problem with the exchange itself (a “transaction malleability issue”).

Bitcoin currency will continue to climb…

Unfortunately, if your stash of coins was part of the 850,000 lost by MTGOX, you might not feel like putting your money back out there to buy some more Bitcoins.

That’s easy enough to understand, I suppose.

But look at Apple (AAPL), “The Most Valuable Technology Company of All Time“. This chart shows a few peaks and valleys too. In fact, when you ignore the rocky road it took during the start of the recession in 2007 – 2009, you’ll still see the value plummet from time to time; sometimes it even gets chopped in half temporarily.

And we all need technology. What would your wife, son, daughter – even mother or grandmother – do without their precious iPhone or iPod?

Paper currency is way more flawed…

Most of Latin America and Asia would tell you that Bitcoin is way more reliable in the long term.

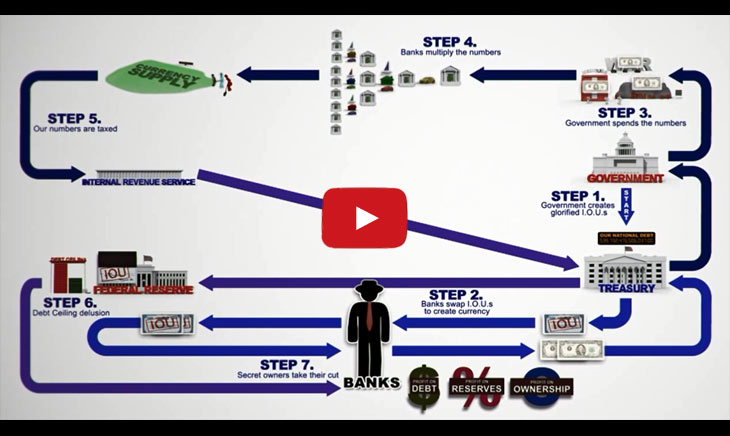

Governments control what the paper in your wallet or bank account is worth, regardless of the currency you have. When they allow factors like inflation to enter the picture, the value of that money can plummet overnight, leaving all of us broke – and likely unemployed too – without warning.

Fiat currency isn’t more valuable or reliable; it’s just more widely accepted – currently.

Wences Casares of Lemon Wallet speculates that Bitcoin is the ultimate alternate source of money currently available, based on experiences he’s had in his home country of Argentina:

“Casares explained how some people in his country are using “old Android phones” to acquire and exchange Bitcoins at a time when the government is clamping down on the trade in U.S. dollars. More remarkable, Casares noted, is that many of the people using Bitcoin don’t know much about technology—but they do know, through hard experience, about currencies and can recognize alternate sources of money.”

Check out the full Businessweek.com article: The Future of Bitcoin: Three Predictions From Experts

If you read the Businessweek.com article from top to bottom, it becomes very obvious that the core of the system is secure. That is, the system that creates the actual Bitcoins is just fine and dandy. Just because an exchange rises and falls, or the wallet stored locally on your computer somehow gets compromised, doesn’t mean that the currency should be devalued – or dead.

What would you do if you lost a wallet containing $200 in cash?

Would you say: “These dollars are worthless, I’m always losing them. I’m not going to use it anymore.”

Of course you wouldn’t, you’d find a better way – or place to store those dollars, wouldn’t you?

Since Bitcoin values have been on a steady climb since the Chinese MTGOX and Canadian Flexcoin exchanges fell recently, it doesn’t take a genius to see that investors aren’t terribly worried about the sustainability of the digital currency.

One advantage to using fiat money…

The only advantage to holding your funds in fiat currency, in a bank, is that it’s insured (to a certain extent.) If Bitcoin were insured, then you wouldn’t have to worry about theft because the regulatory bodies would back your money.

However, the surviving Bitcoin exchanges and future up-and-comers have learned a hard lesson from the recent security problems, and they’ll use the information gleaned from those thefts to make our coins even safer in the future.

Bitcoin investors need to worry about where they hold their coins, not the coins themselves.

And one can only hope that everyone just relaxes a bit. If we continue to worry and complain, soon enough Bitcoin will cease to be the people’s money.

Imagine how much the value will plummet once the central banks and governments of the world have a say in its value, and what you can (and can’t) do with it?

Photo credit: Jason Benjamin